The Billion-Dollar Lie: What Female Founders Need to Know About the Rhode $1B Deal

- Built on YES

- Jun 6, 2025

- 9 min read

The real numbers behind the Rhode sale, cap tables, dilution, and why founders must build brands with both grit and clarity

This case study includes the following sections:

3 Deals from 3 Female Founders in the past 3 Months…

These headlines are massive. But let’s pause the champagne pop for a second. What did the founders actually pocket? What do these numbers mean for your business? And what should you know before your name ends up in a press release?

Let’s break down what Hailey actually pockets, wtf $1B actually means, how a lawsuit nearly shut it all down, and how another Rhode closed its door COMPLETELY…

FYI, it’s not just celeb drama, it’s a case study and a wake-up call for entrepreneurs about brand identity, power imbalance, financial literacy and equity, and emotional clarity.

Let’s talk about the facts first.

Quick Math: $1B Rhode price tag = $600M Cash + $200M Stock + $200M earnout

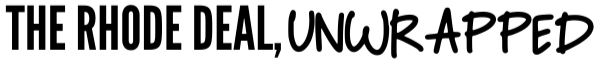

It’s not just Hailey’s face that made this so valuable, it’s about brand strategy that made Rhode so f*cking valuable and acquisition worthy.

With only 10 SKUs, Rhode built a wildly effective user-generated content machine, used drop-culture to drive hype, and positioned itself with a minimalist, skin-first aesthetic.

Hailey became less the face and more the spokesperson. That shift made Rhode a stronger acquisition target, investors love scalable brands that aren’t tied too tightly to a single personality.

Many investors do worry about the impacts of celebrity endorsements and brand ownership due to PR and public scrutiny.

Since Rhode didn’t have to rely on Hailey’s personal brand to grow the business, they were able to use their own community to scale and drive their sales.

Here’s where e.l.f. needs Rhode…

Rhode is exceptionally great at growth and has a clear market share. E.l.f. now gets access to that market share and their secret sauce for growth. Especially with e.l.f. being a more cost-conscious brand in the current economic insanity climate, this now gives the opportunity for e.l.f. to have access to customers they didn’t have before in a way they didn’t know how to grow or capture.

A strong brand identity, innovative marketing, and a loyal customer base are highly valuable assets for any brand, and this can attract strategic acquirers looking to either diversify or enhance their needs.

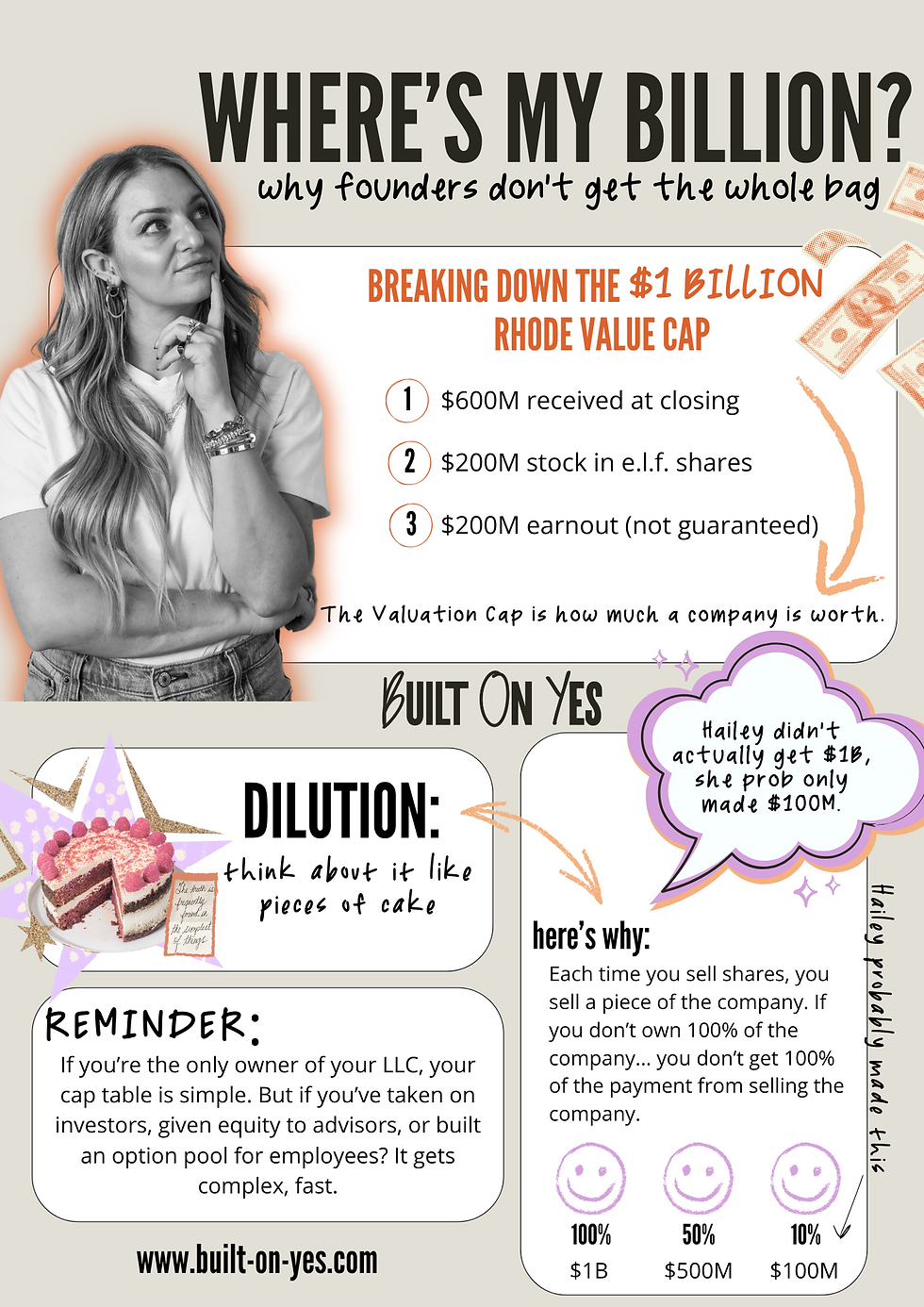

Where’s My Billion? (Why Founders Don’t Get the Whole Bag)

Hailey didn’t actually get $1B. She prob only made $100M.

Remember this was the deal: $1B price tag = $600M Cash + $200M Stock + $200M earnout

Let’s do a quick easy breakdown first:

$600m in cash is received at closing.

$200M stock in new e.l.f shares at closing. This means that owners of Rhode stock will now be partial owners in e.l.f. stock.

The $200M earnout is not guaranteed. This is a potential earning opportunity that is tied to Rhode’s future business growth. So, if they don’t hit their goals within the next 3 years, they don’t get the earnout money.

The “valuation cap” is how much the company is worth, meaning e.l.f thinks Rhode is worth $1B. However, valuation is always tricky to decide. Just like in any other business it’s only worth what someone is willing to pay for it, there are a few different ways to calculate valuation depending on the type of business. In this case, e.l.f most likely used an EBITDA multiplier and future growth. Here’s why, e.l.f. created a way to not overpay or underpay the value of Rhode by giving actual cash, additional stock options, and the potential to earn even more.

So, Hailey didn’t receive $1B because of the structure of the deal, but also because of basic corporate finance reasons. She doesn’t own 100% of the company.

If you own 100% of your company right now and sold it for $1M, you would get $1M. However if you own 50% of your company and sold it for $1M, you would get 50% of $1M = $500k.

Let’s keep going further, and switch up the numbers:

If you are running a really big business and you’ve already brought in investors, and you now own 10% of your company and your company sells for $1B, you would receive $100m.

Here’s why: dilution.

Each time new stock is issued, there is a decrease in ownership for existing shareholders. It’s a natural part of the process. Think about it like a cake: every time you sell shares, someone gets a piece of cake. You started with 100%, then as you gave away more and more pieces because you needed someone to help you eat it, your slice gets smaller and smaller.

Based on all of the above, we can maybe assume Hailey has around or below 10%, based on industry averages, so she is, based on assumptions below, potentially receiving 10% of $1B, which is $100M.

*Data from venture-backed startups so that ownership can decline 50% after their initial round, to 20% at their Series B, then by the time they hit IPO, they are anywhere between 2 to 6%. Many founders hold under 5% of equity at IPO. Since she didn’t IPO, many founders in the high-value exits tend to have below 10-15% equity.

*(View all the sources at the bottom of this article.)

M&A Deal Structures: It’s Not All Cash, Honey

Let’s dive a little deeper into the actual structure and define some terms.

Cash: Paid at close, divided by ownership and deal terms

Stock: You now own a slice of the buyer’s company

Earnout: Only paid if performance milestones are hit

Cash is well, cash.

However, all of that cash is accounted for. So the $600M of cash Rhode received is distributed to founders, employees with equity, and other investors. Each get a little piece of the $600m cake. (Note: the deal is closed and not public, so it is unknown the detailed terms, dilution, and terms of each of their shares. Besides the basics of the deal, everything else is based on assumptions.)

Stock is either Common Stock or Preferred Stock.

Common Stock is usually reserved for the founders, employees, and sometimes early-early-early investors. This stock gets perks, so don’t be fooled by the name “Common.” However, they are paid LAST. So, in Hailey’s case, not only is her cake piece very small, but depending on how many people need the cake and the terms of the deal…she could potentially get none.

Preferred Stock is what most investors get. They get paid first, and they can negotiate for other rights such as voting, payout preferences (called Liquidation Preferences), future share purchases, and future dilution.

Remember, this is tied to the performance of the business, so if e.l.f isn’t doing well and the stock price drops, so does the potential payout.

Earnouts are financial FOMO.

“Vesting” is the process that allows founder, employees, and investors to earn their equity over a defined period of time. This is usually implemented as an incentive so that the founders and employees don’t leave after they get their first big payout. In Rhode’s situation, they must hit certain milestones by the end of year three in order to receive the next $200M.

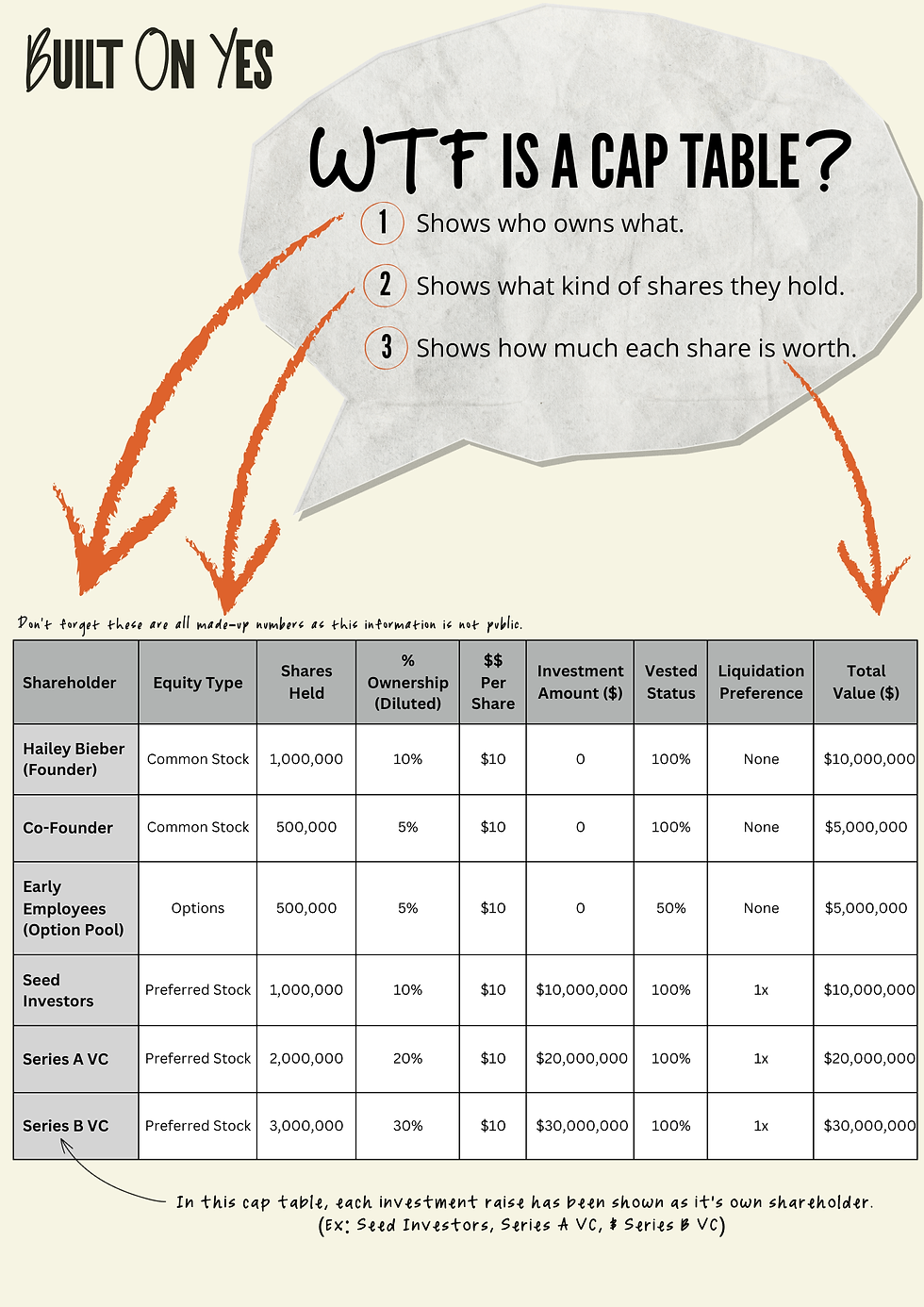

Your capitalization table (cap table) is your company’s ownership map. It shows:

Who owns what

What kind of shares they hold (common vs. preferred)

How much each share is worth

If you’re the only owner of your LLC, your cap table is simple. But if you’ve taken on investors, given equity to advisors, or built an option pool for employees? It gets complex—fast.

Founders, especially female founders and small business owners, need to own their understanding of cap tables. Because this is the blueprint for who gets what when you sell.

The Lawsuit That Silenced a Legacy

Rhode vs Rhode?!?!?

Rhode-NYC, a well-established clothing brand founded in 2013 by Purna Khatau and Phoebe Vickers, was an ethically conscious clothing and accessories brand. They even had their brand in stores like Saks Fifth Avenue, Neiman Marcus, and were worn by celebs. In June 2022, Rhode-NYC had projected sales of $14.5 million for 2022… needless to say, this was no little clothing brand.

When Hailey launched Rhode in June 2022, Rhode-NYC filed a trademark infringement lawsuit against Hailey due to consumer confusion, using an identical name, and “threatening brand reputation.”

FYI, Hailey tried to trademark “Bieber Beauty” in 2019 and was rejected. Rhode-NYC also stated that Hailey tried to purchase the Rhode trademark back in 2018, which Rhode-NYC declined. Basically, that shows that Hailey KNEW the names were identical.

So much happened during this lawsuit. Rhode-NYC was going up against a mega celebrity, which is a clear power imbalance and a total competitive disadvantage for Rhode-NYC. Rhode-NYC even filed a complaint that Hailey was trying to “squash a woman- and a minority co-founded brand that simply cannot compete.”

Hailey’s legal team was strategic and focused on the fact that she was “skincare” and they were a clothing company, which when you file a trademark you have to say it’s intended use. Rhode-NYC again tried to say there was confusion amongst the brand names.

Ultimately, in July 2022, the judge denied Rhode-NYC’s indjusction, which would have stopped Hailey from using the name “Rhode.” Rhode is Hailey’s middle name and her brand is skincare, so the judge allowed Hailey to continue the name use.

…two years later. That’s A LOT of legal fees…

The parties reached an undisclosed settlement.

Because the judge denied Rhode-NYC originally, that means they needed to continue to fight a legal battle for their name.

The settlement was finalized in July 2024, and in December 2024 Rhode-NYC announced it’s closure, and said it would cease operations by the end of July 2025. While they didn’t explicitly say it was because of the lawsuit it’s clear it took a toll on the business and founders. They did say previously the lawsuit was “hurting our company, our employees, our customers and our partners” and they “cannot overcome a celebrity with Hailey’s following.”

This wasn’t a failure of branding. It was a brutal example of how power imbalance, legal resources, and celebrity influence can outweigh trademark law.

The Built on YES Reality Inventory: Brand Ownership Edition

This reality inventory isn’t just mindfulness prep, it’s legal prep, a gut-check, and clarity around ownership, identity, and resilience.

Reflect and recalibrate by:

Answer YES/NO or download the checklist to keep with you and update!

Part 1: Strategic Awareness

I know who owns what in my company—cap table and IP included.

I have trademarks filed in current and future-adjacent categories (e.g. apparel, wellness, digital).

I understand what “reverse confusion” is—and how I’d protect against it.

Part 2: Emotional Clarity

I’ve thought about how I’d feel if someone used my name as a brand and scaled faster than I did.

I’ve explored the emotional attachment I have to my company name, identity, and vision.

I’ve visualized what it would take for me to walk away from a fight—and what would be worth staying for.

Part 3: Resilience & Resources

I have a plan or trusted advisor for legal escalation if needed.

I’ve budgeted (mentally or literally) for emotional/mental health support in high-stress brand or legal moments.

I’m building a brand that can outlive my face, my feed, or my founder status.

Conclusion: Know What You’re Building Toward

Here’s the real deal, founder to founder:

A $1B headline doesn’t mean a $1B payout. Between dilution, deal structure, and equity terms, what looks like a windfall might be a well-disguised spreadsheet.

And as we saw with the Rhode lawsuit, brand identity doesn’t always win when power and celebrity enter the chat. You must understand what you own, how you own it, and what you’re building toward.

Use this moment as a mirror.

If you only remember one thing, let it be this: Foundership is a marathon, not a headline.

You don’t need to aim for a billion-dollar exit. But you do need to know what your brand is worth, who owns it, and what you’re willing to fight for.

Whether you’re a startup founder, a solo service provider, or a brand-building dreamer, check your cap table. Register your name. Learn the language of ownership.

Because you are courageous. You are capable. And you are strong.

Additional Case Studies by Built on YES:

Sources

This blog pulls from publicly available articles, legal commentary, and founder data to provide insights into the Rhode acquisition, brand equity, and ownership strategy. Key sources include:

These references support a broader understanding of business acquisitions, dilution, and the high-stakes reality of branding as a female founder.

Comments